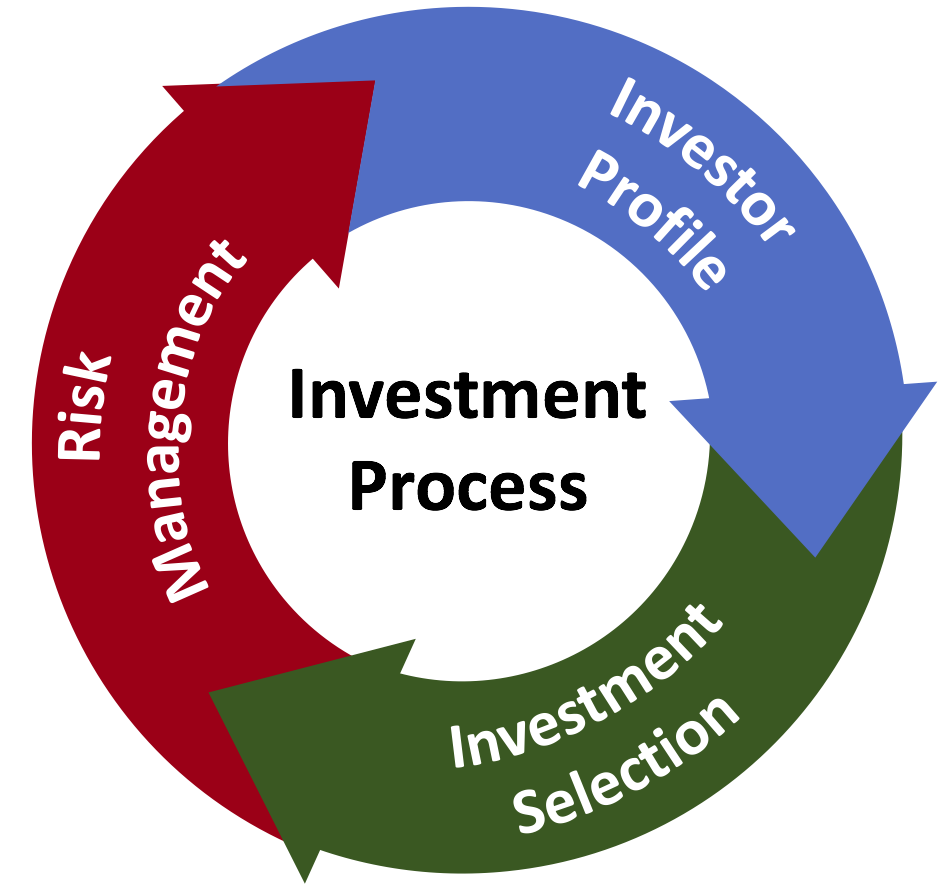

Investment Process

The investment process at L Squared Wealth Management consists of three steps. First, we work with you to determine your investor profile. There are a number of elements that go into determining this including your age, financial status, time horizon, and risk tolerance. Once we have determined your investor profile, we select investments that are appropriate for you. This includes allocations to stocks, fixed income, and real assets.

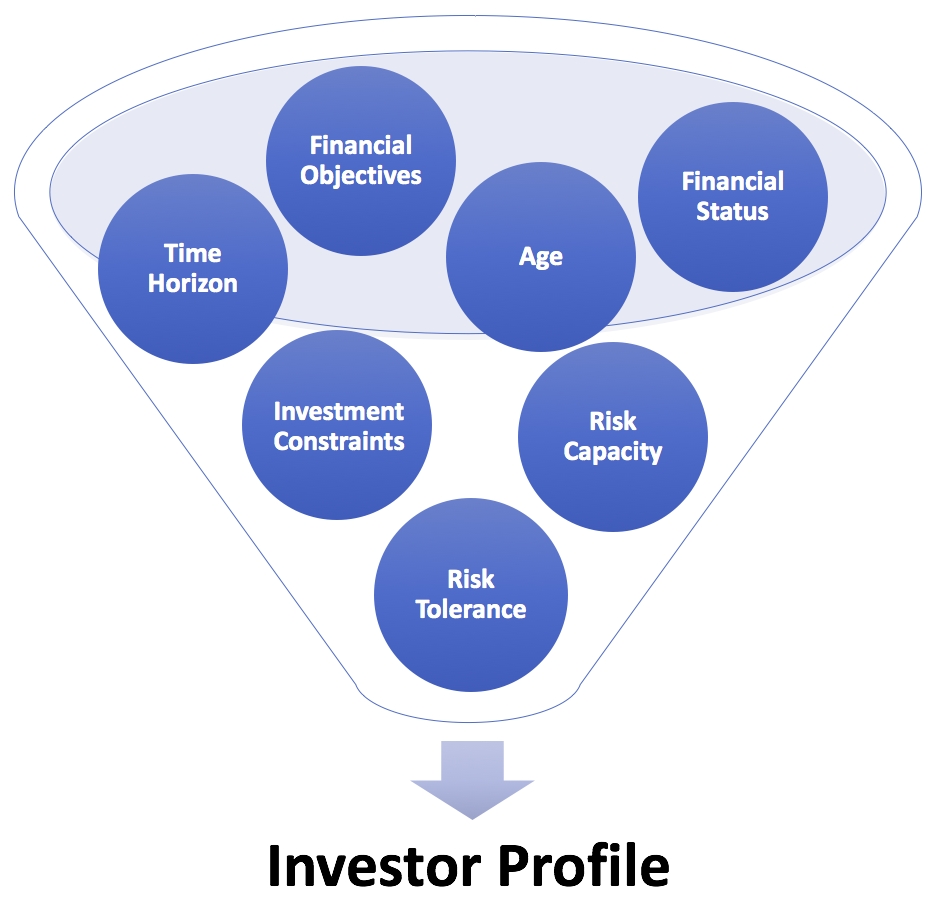

Investor Profile

Your investor profile determines the appropriate investments for your portfolio. Your profile is determined by a number of factors. Some of these are quantitative such as your age, time horizon, risk capacity, and financial status. Others are more subjective such as your financial objectives, risk tolerance, and any investment constraints. Based on all these factors, we determine an overall portfolio allocation that is right for you.

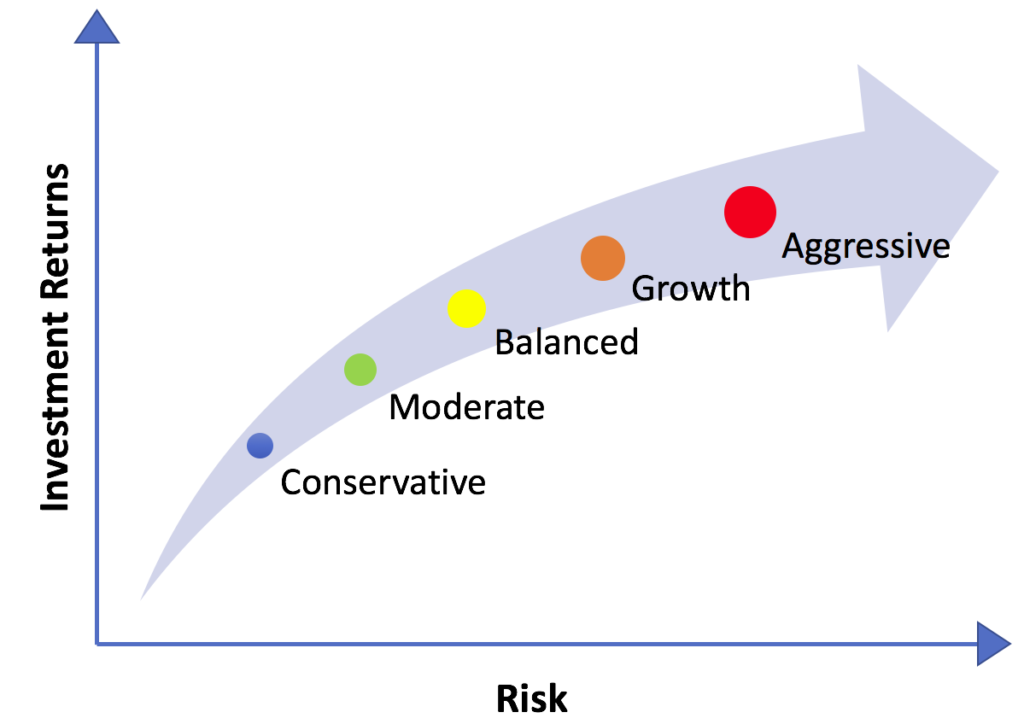

Investment Selection

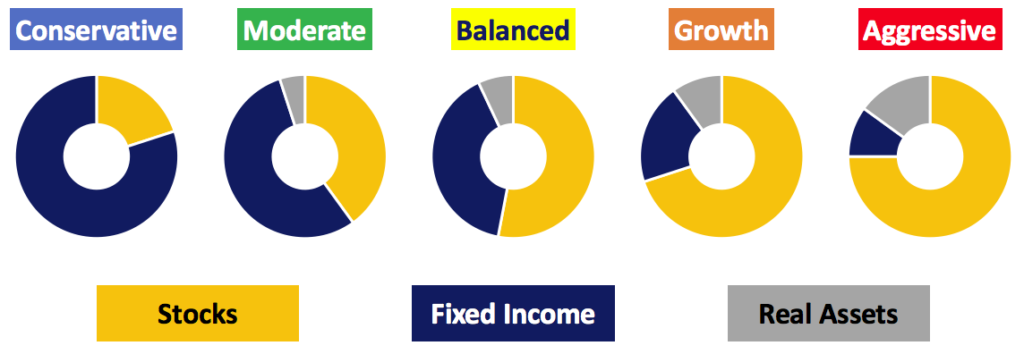

Portfolio allocations are a balance between risk and reward. In general, the more risk you take, the greater the potential gains. These larger gains come with an increased susceptibility to losses. Depending on your investor profile, your portfolio allocation can range from conservative to aggressive. Typically, stocks (equities) have higher risks than bonds (fixed income). Aggressive portfolios have a larger allocation to equities while conservative portfolios have larger allocations to fixed income.

We use a combination of mutual funds and exchange traded funds (ETFs) in your portfolio. These type of investments provide diversification to reduce the risk that can arise from investing in only a few companies.