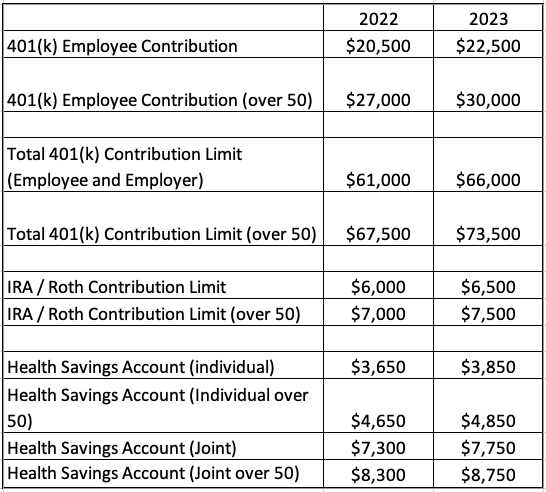

Inflation in 2022 has been the highest since the early 1980s. In general, this is bad news as the cost of everything goes up. One rare silver lining is that contribution limits for 401(k)s and IRAs is linked to inflation. This means that contribution limits are increasing substantially in 2023. The table below shows some of these increases.

If you would like to take advantage of these increased limits, make sure to increase your 2023 payroll withholdings.

L Squared Wealth Management provides financial planning, including retirement planning. If you would like to talk about your retirement plan, feel free to contact us at info@L2Wealth.com.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, a California registered investment advisor firm. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.