The US stock market (large companies) has returned approximately 10% annualized for the period from 1926 – 2017 according to data from Morningstar. Talk to almost any financial advisor or read an investment article on-line, and this number is often cited. It is no wonder that the typical investor expects their portfolio to return 10% per year. This doesn’t even take into account that a diversified portfolio would have an allocation to fixed income. US government bonds had an annualized return of 5.5% from 1926 – 2017. Hence, a diversified portfolio (60% stocks and 40% bonds) would have returned closer to 8% during that period. Most of us would jump at an 8% rate of return today. However, the truth is, market returns have varied dramatically over time.

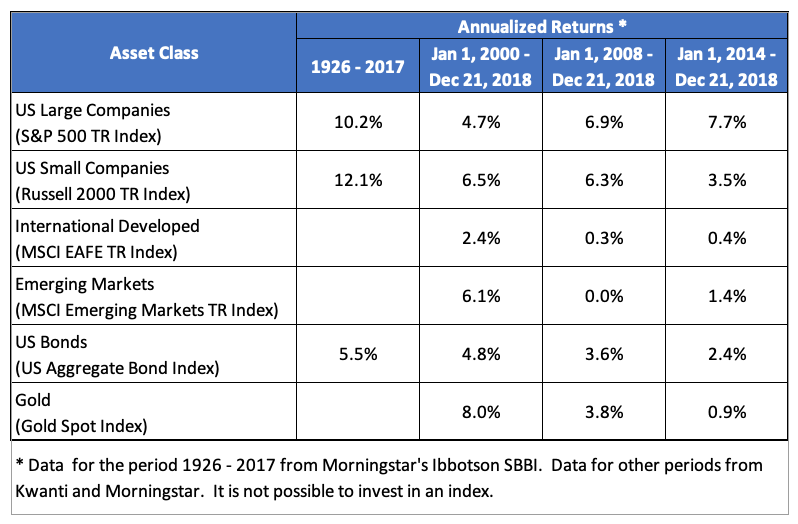

There was a long period during and after the Great Depression in the 1930’s and 1940’s where the market produced negative returns. On the other hand, the 1990’s saw returns far in excess of 10%. Unfortunately, none of us invest for a 90 year investment period. Our typical investment timeframe is 30-40 years. The market cannot be counted on to deliver 10% returns during our target investment period. In fact, we have no control over the returns the market will produce. The table below shows returns for several periods since the end of the 1990’s compared with historical averages:

Returns for the 2000’s have been substantially lower than long-term averages. Currently, we are living in a world with low interest rates, low economic growth, and low inflation. None of these are supportive of higher market returns. This creates a problem when we are trying to build up our savings for retirement and other financial goals. If we use a return of 10% in our assumptions, we could substantially miss our financial target.

What is an investor to do? The typical strategy is to diversify your portfolio, rebalance it periodically, and hope that markets perform as they have historically (at least before the 2000’s). Unfortunately, hope is not a great investment strategy. At L Squared Wealth Management, we believe there are better ways to invest. By focusing on limiting losses in downtrends through risk management strategies, it may be possible to get ahead in the long-run. While we believe our risk management strategies can help you achieve your long-term financial goals, it should be kept in mind that no strategy can be guaranteed to produce a profit or protect against a loss. If you are uncertain about your investments, feel free to contact us at info@L2Wealth.com.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, a California registered investment advisor firm. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.