Bitcoin has been all over the news lately, with its meteoric rise in 2017. The cryptocurrency started 2017 just under $1,000. As the year closes, it is approaching $20,000, an approximately 2,000% return. Bitcoin has certainly caught the attention of the mainstream population. Most have very little idea what it is or its purpose. For many, it is just a lottery ticket with a “sure” payout.

Bitcoin has been all over the news lately, with its meteoric rise in 2017. The cryptocurrency started 2017 just under $1,000. As the year closes, it is approaching $20,000, an approximately 2,000% return. Bitcoin has certainly caught the attention of the mainstream population. Most have very little idea what it is or its purpose. For many, it is just a lottery ticket with a “sure” payout.

Here is a little bit of background about bitcoin. Bitcoin is part of the blockchain technology. The goal of the blockchain is to eliminate the middle man (banks and governments) from transactions. The blockchain serves as a public record of all transactions, providing a “trusted” ledger for all activity. The transactions that have occurred in the past cannot be changed, only new transactions added to the end of the blockchain. Bitcoin is the digital currency of the blockchain.

Bitcoins are created digitally. To “mine” a bitcoin, it requires a huge amount of computer power to solve a complex mathematical problem. One of the defining characteristics of the bitcoin technology is the total number of available bitcoins is limited to 21 million. This is very different than currency, such as the US dollar, where a government can decide to print as many dollars as desired, potentially creating inflation in the long run.

Bitcoin has a number of advantages. These include:

- Limited supply – only 21 million will ever exist providing a stable store of value (similar to gold)

- Decentralization – distributed technology not controlled by one government

- Ease to set-up – no need to jump through hoops to set up an account at a bank

- Anonymous – no one knows the identity of someone making a transaction

- Transparency – the blockchain has a public ledger of all transactions

- International – transactions can be completed anywhere in the world

- Non-Repudiable – once a transaction is completed, it cannot be reversed

Clearly, there are many advantages to the blockchain technology (as well as many illicit uses), and the concept is not going to go away. Unfortunately, for the most part, bitcoin is being used as a speculative tool and not as a currency substitute. Very few transactions are conducted in bitcoin. Few people think about buying a cup of coffee or a TV using bitcoin. Most are just buying and selling bitcoin (which they don’t understand) to make a few dollars (or a lot of dollars).

The instability of the price of bitcoin makes it difficult to use as a currency. Imagine if a country adopted bitcoin as its currency. We’ll call the country Bitcoinesia. Prices and salaries would be denominated in bitcoin. Due to the huge rise in bitcoin in 2017, anything bought from other countries (imports) that do not use bitcoin would be super cheap. Unfortunately, Bitcoinesia would not be able to sell anything to other countries since the price of its products would have increased by 20x in the currency of the other countries. This means a lot of the jobs in Bitcoinesia would disappear. Also, no one would be able to afford to visit Bitcoinesia, at least until the value of bitcoin declined dramatically.

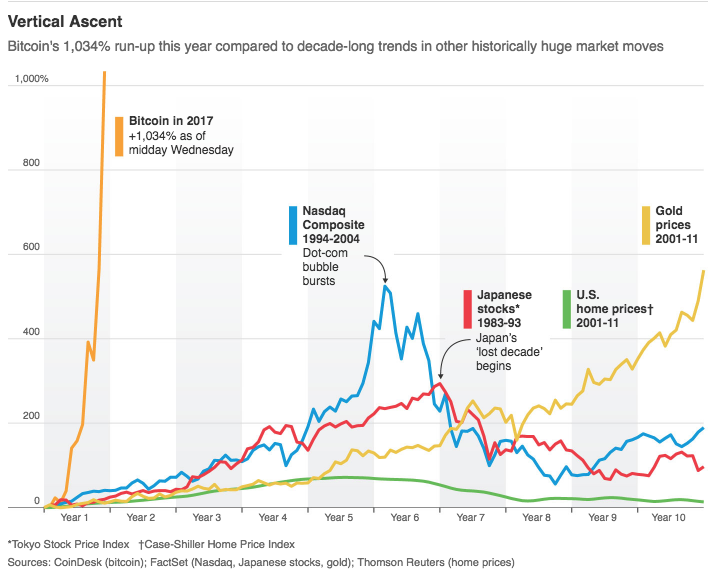

The exponential rise in the value of bitcoin in 2017 has all the markings of a bubble, similar to Tulip mania in the 17th century. During that bubble in Holland, the value of tulips increased dramatically. At its extreme, one tulip could be worth as much as a house! It’s interesting to compare the rise of bitcoin in 2017 to other recent bubbles such as the Japanese stock market in the 1990’s, the Dot-com boom and bust in the late 1990’s, and the housing bubble in the early 2000’s. The chart from the Wall Street Journal (Bitcoin Mania: Even Grandma Wants In on the Action – 11/29/2017 ) below shows the comparison when bitcoin was around $10,000 (only a few weeks ago!). Clearly, the appreciation in bitcoin has been dramatically higher than the other recent bubbles.

It’s impossible to tell when a financial bubble will burst. It’s certainly possible that bitcoin could go much higher before it declines dramatically. There are many things that can precipitate a decline. Probably tops on the list would be some kind of global government ban on the use of bitcoin. At some point, the bubble will burst. This doesn’t mean bitcoin and the blockchain technology have no value. Most technology companies did not disappear after the Dot-com bust, but their value decreased dramatically. Clearly, blockchain-type technology will continue to exist and may ultimately account for the majority of worldwide transactions. Until that time, Caveat Emptor (Let the Buyer Beware)!

Feel free to contact us with any questions or comments at info@L2Wealth.com.

Disclosures:

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.