Today, the Dow Jones Industrial Average (DJIA) rose above 20,000 for the first time ever. At the same time, other market indices, including the S&P 500 and the NASDAQ Composite also reached all-time highs. The recent market highs follow the election of Donald Trump as President of the United States. Trump’s promises of reduced corporate and individual taxes, and less regulation of the economy, have reinvigorated the almost 8 year-old bull market.

Today, the Dow Jones Industrial Average (DJIA) rose above 20,000 for the first time ever. At the same time, other market indices, including the S&P 500 and the NASDAQ Composite also reached all-time highs. The recent market highs follow the election of Donald Trump as President of the United States. Trump’s promises of reduced corporate and individual taxes, and less regulation of the economy, have reinvigorated the almost 8 year-old bull market.

Round numbers, like Dow 20,000, tend to catch the attention of investors as well as non-investors. Sometimes, these round numbers are a prelude to a market downturn. For example, the Dow first rose above 10,000 in March 1999. This was followed by the Dot-com meltdown in 2000-2002. In other cases, the market continues to go up. The Dow rose above 15,000 in May 2013, and has continued to rise.

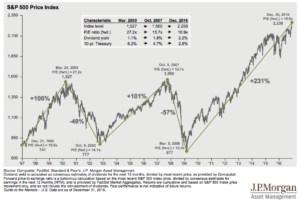

One question many investors have is what happens next. While it is tempting to try to predict the future direction of the market, it is mostly a fool’s errand. No one can consistently predict what the market will do next. If anyone tells you they can predict the direction of the market, run the other way! Markets can remain overvalued or undervalued for long periods. Many times, markets continue to move up (or down) for extended periods. Part of this is due to the effect human emotions (greed and fear) have on investor behavior. When the market is making new highs, like now, we want to participate in the profits (greed). This can result in a continuation of the upward move of the market. On the other hand, when markets are falling, we want to sell to avoid further losses (fear). The chart below shows trends in the market over the last 20 years.

The market may continue to go up in the near-term. At the same time, one thing that is certain is there will be a downturn in the market at some point. It is anyone’s guess what will precipitate the next downturn. It could be a trade war or a recession or even armed conflict somewhere in the world. Rather than trying to time the market, you should make sure your investment portfolio is right for you. Your portfolio should be allocated according to your goals, time horizon and risk tolerance. If you are uncertain about your investments, a financial advisor can help you with the many factors and decisions involved with investing.

Feel free to contact us with any questions at info@L2Wealth.com.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.