Recently, high-yield bonds, otherwise known as junk bonds, have been in the news following the collapse of the Third Avenue Focused Credit Fund. This mutual fund invested in some of the riskiest and least liquid bonds and corporate bank loans. The fund was already down 27% in 2015. As investors tried to get their money out, the fund blocked investor redemptions until the assets could be liquidated without having to sell at fire-sale prices. This process could take a year or more.

Since the financial crisis of 2008, interest rates on savings at banks have dropped to near zero. Many investors have been reaching for a little extra yield (or interest) without fully understanding the risk they are taking. Most investors buy bonds for the interest they pay. Unlike a savings account or CD at the bank, there are no guarantees that the bond investment will be repaid. Bonds of more profitable and secure companies (investment grade) pay lower yields than bonds of more risky companies (high yield or junk bonds). The higher yield attempts to compensate the investor for the added risk of the junk bond. Today, it is tempting to buy a bond fund with a yield of 5% or more, but extra yield comes with increased risk. There is no free lunch. Many high yield bond funds hold a considerable number of bonds issued by small and mid-size energy companies. As oil prices have collapsed over the last year, the financial viability of some of these companies has become questionable. As a result the value of their bonds has decreased, and there is a danger that some of these bonds won’t be paid back.

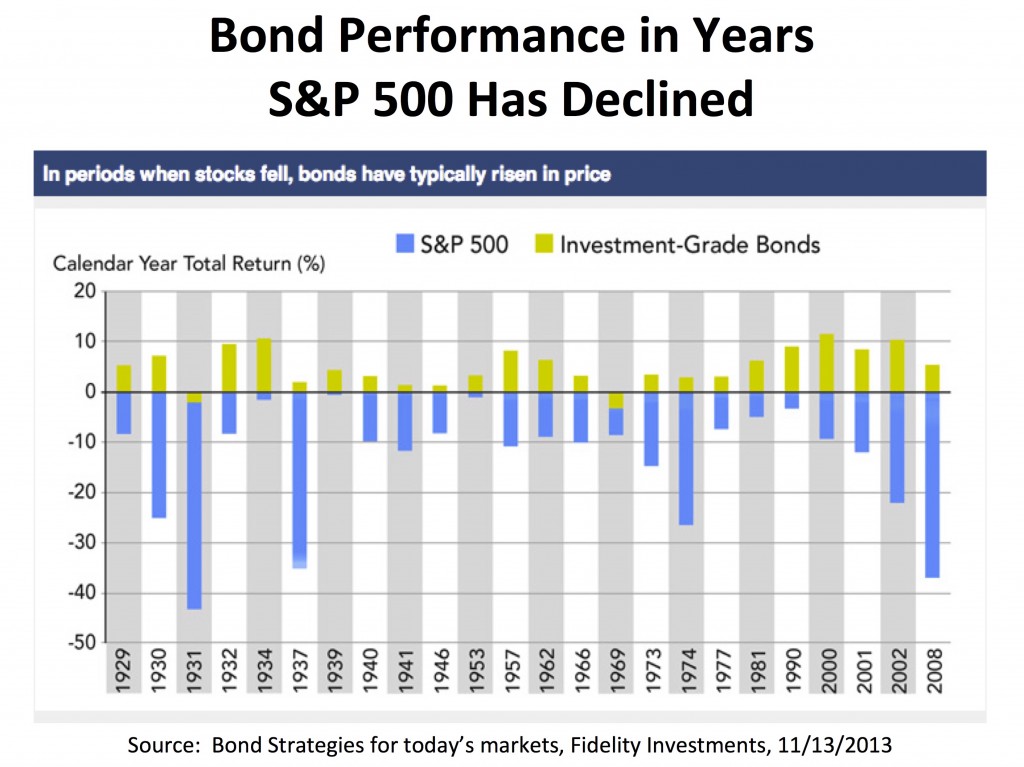

Investment grade bonds typically have low or even inverse correlations with stocks. This means that as stocks go down, the bonds usually hold their value or may even increase in value. The chart below shows the performance of investment grade bonds in years where the S&P 500 has decreased in value. In most of these years, the bonds have actually increased in value, offsetting some of the stock losses.

Unfortunately, high yield bonds often behave more like stocks, especially when the stock market is down. In 2008, the S&P 500 was down 37%. High yield bonds (Credit Suisse High Yield Index) were down over 26% in that year, while investment grade bonds (Barclays Aggregate Bond Index) were up a little over 5%. Since 1980, the worst yearly return for investment grade bonds was -2.92%. In a diversified portfolio, investment grade bonds can help balance some of the risk of owning stocks. Other yield producing assets, such as dividend paying stocks, real estate investment trusts, and MLPs may offer juicy yields, but have more downside potential than investment grade bonds.

It’s important to understand your investments to avoid nasty surprises when markets decline. Higher returns typically comes with higher risks. A financial advisor can help with the many factors and decisions involved with investing.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.