Market volatility continued in September with US markets down 2.5% for the month as measured by the S&P 500 TR Index. US markets are now down 5.3% for the year. International markets continued to struggle as well with the MSCI ACWI TR Index down 4.6% in September. Emerging markets have been especially hard hit and are down around 16% for the year, with all of the damage occurring in the 3rd quarter.

Market volatility continued in September with US markets down 2.5% for the month as measured by the S&P 500 TR Index. US markets are now down 5.3% for the year. International markets continued to struggle as well with the MSCI ACWI TR Index down 4.6% in September. Emerging markets have been especially hard hit and are down around 16% for the year, with all of the damage occurring in the 3rd quarter.

On Sept 17, the Federal Reserve decided not to raise interest rates from the zero boundary that they have been stuck at since the 2008 financial crisis. Since the Fed decision was announced on Sept 17, the S&P 500 is down almost 4% through the end of September. The last time the Fed raised interest rates was in July 2006, over nine years ago! The US economy seems to be doing well with low unemployment and low inflation. The rationale given by the Fed was mostly related to the uncertainty in the world economy, especially China. The Fed has meetings in October and December so it remains to be seen whether it will raise rates this year.

The US government still has not approved a budget for the fiscal year that starts October 1, 2015, but averted a shutdown by passing a short-term spending bill on September 30. This will keep the government open until around mid-December. It remains to be seen whether Congress will pass a budget before then. This could lead to further stock market volatility.

The Chinese stock market continued to struggle as well, dropping 4.8% for the month of September. The Shanghai Index is now down 5.6% for the year, but an incredible 41% from its peak in June. Concerns in China center around the slowdown in the economy, with growth predicted to be less than the official 7%.

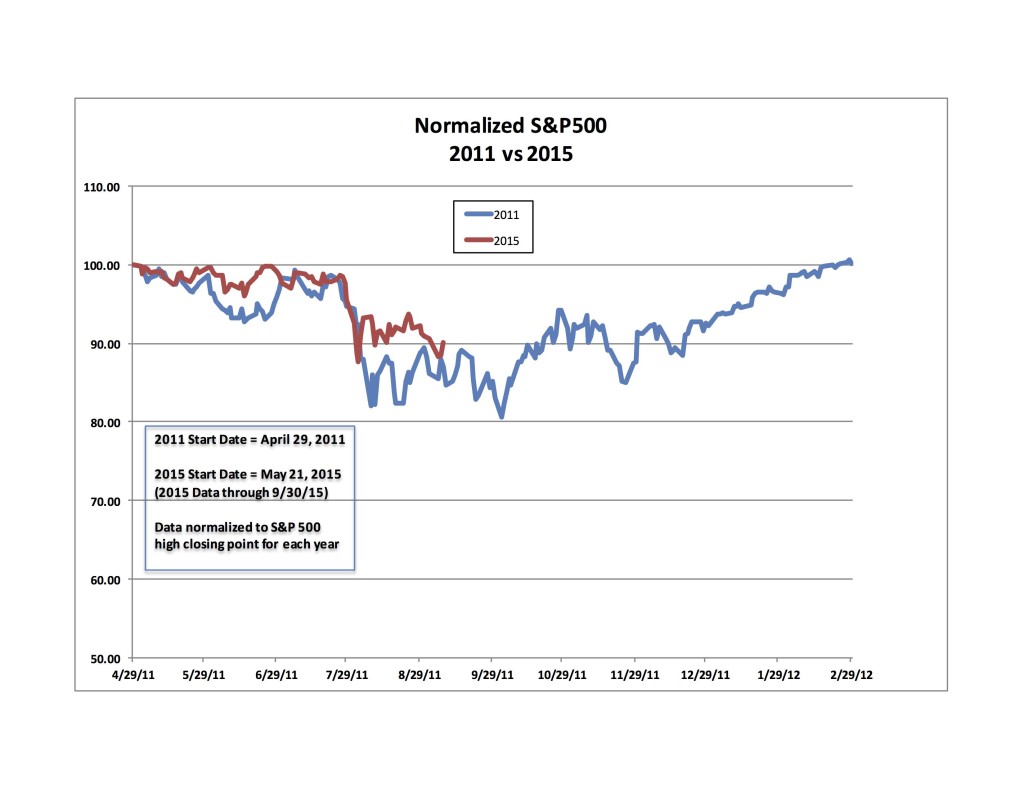

October is often a challenging month for the markets. As such, market volatility will probably continue for a bit longer. Overall, this market correction looks a lot like the one that occurred in 2011. In 2011, the market ultimately bottomed in October, and continued to be volatile until December, before resuming its upward trend. It remains to be seen whether 2015 will continue to follow a similar pattern.

Feel free to contact us with any questions at info@L2Wealth.com.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results.