It’s that time of year again when college seniors head into the real world. First of all, we would like to congratulate all the new grads on their achievement. Luckily, the job hiring environment is better this year than it’s been in a long time, with the unemployment rate around 5.5%. New grads are often bombarded with advice and ideas, some good, some not so good. One lesson that is as important for new college grads as for the rest of us is the benefit of saving from an early age and allowing our investment to grow through the magic of compounding.

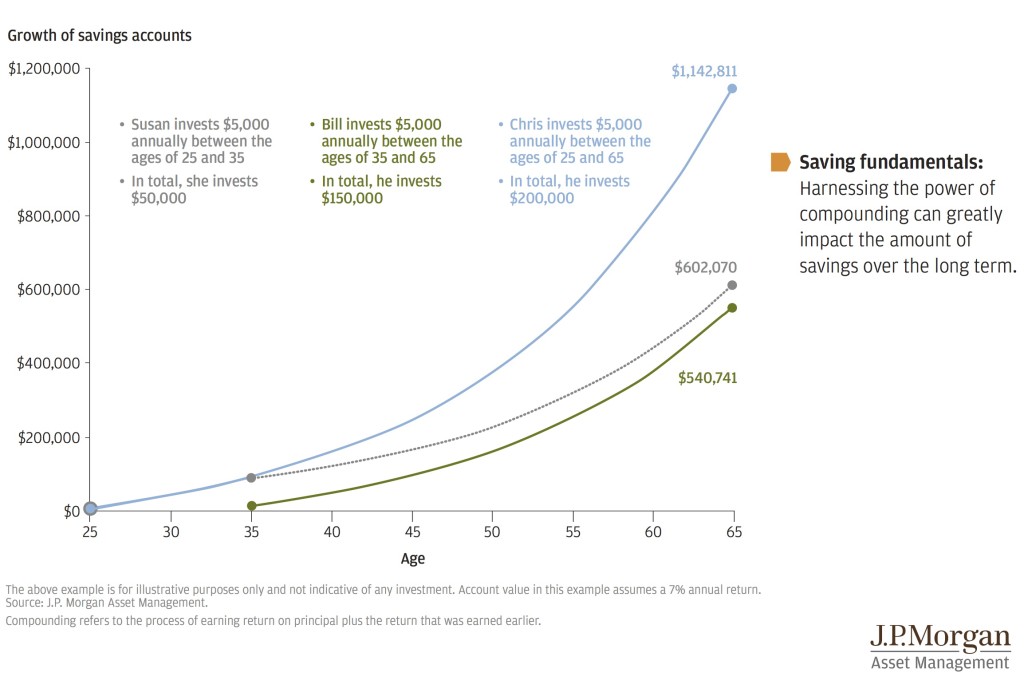

Consider the graph below showing 3 different investors. The graph assumes an annual return of 7% per year for the entire period. Susan invests $5,000 a year from the age of 25 to 35 and then does not invest again. Over the 10 years, she invests a total of $50,000. Yet, through the magic of compounding, her portfolio grows to $602,070 by the time she reaches 65. Bill does not start investing until he reaches 35. He then invests $5,000 a year for the next 30 years. This is a total of $150,000 over the 30 year period. His portfolio grows to $540,741 by the time he reaches 65. However, due to the power of compounding, Susan’s portfolio is actually worth more than Bill’s, even though Bill invested 3 times as much as Susan! A third investor, Chris, invests $5,000 a year for the whole 40 year period. His total investment of $200,000 grows to $1,142,811 by the time he reaches 65.

So the lesson for the new college grad is to start saving and investing as early as possible and let the magic of compounding do its work!

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results. Share prices and returns will vary so investors may lose money, especially when investing for short periods of time. No strategy can guarantee a gain or ensure against a loss.