I am often asked my prediction for the market. I typically tell people the truth: I don’t know what the market will do, especially for the short term. Good news doesn’t necessarily translate into higher stock prices, and conversely, bad news doesn’t always translate into lower prices. Honestly, I don’t believe anyone can predict the market on a consistent basis. If they tell you they can, run the other way.

Looking at the longer term, the compound annual return of US Large cap stocks is 10.1% for the period 1926-2013 according to Ibbotson, a division of Morningstar. Given this, it would seem prudent to remain in the market for the long-term, although past performance certainly doesn’t guarantee future results.

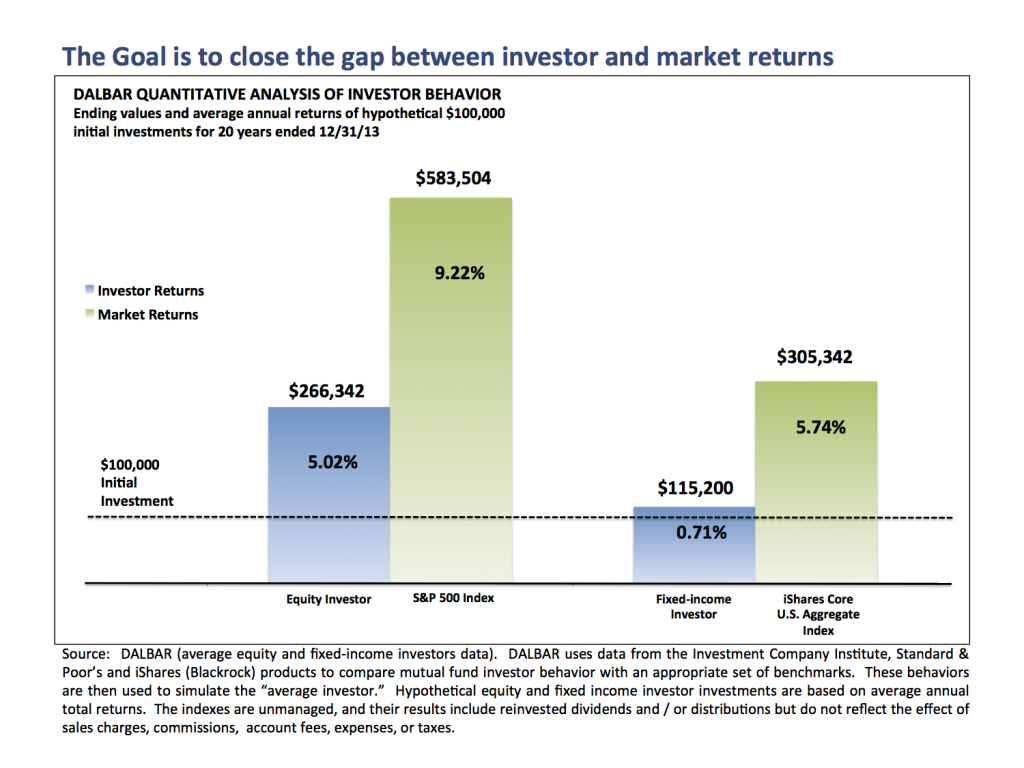

Many of us are our own worst enemy when it comes to investing. The average investor has significantly underperformed the market historically. According to Dalbar’s Quantitative Analysis of Investor Behavior, the average 20 year returns for fund investors has significantly lagged the overall market return. According to Dalbar, the typical equity fund investor has average annual returns of 5.02% for the 20 years ending December 31, 2013. The S&P 500 return for the same period is 9.22%. Results are even worse on the fixed income side. The typical fixed income fund investor has annual returns of 0.71% for the same 20 year period, while the iShares Core (Blackrock) Aggregate Bond Index has returned 5.74% annually. The figure below shows how these differences add up for an initial $100,000 investment, and the results are substantial.

There are a number of reasons for the underperformance by investors. The majority of these are related to our own behavioral biases. Our emotions drive our decisions, especially in difficult financial times. Here is a summary of some of these harmful behaviors:

Greed, Fear, and Recency Bias:

“Amidst difficult financial times, emotional instincts often drive investors to take actions that make no rational sense but make perfect emotional sense” (Blackrock 2012). We tend to be driven by our short-term memory. We put too much weight on current data and events and not enough weight on past, historic trends. People tend to want to buy when the market has had an extended upturn. The Greed instinct kicks in. For example, the highest bullish reading in the AAII Sentiment Survey occurred in January 2000, right before the dot-com bubble burst. After the Great Recession in 2008, many people pulled their money out of the market. Pessimism peaked in March 2009, precisely when the market reached its bottom. Many investors remained out of the market while it proceeded to more than double over the next 5 years. Since many of these people sold in 2008 or 2009 after realizing significant losses, they were much worse off than if they had just left their funds invested and did nothing. We need to fight our Greed and Fear instincts and remember to look at the long-term rather than an unrepresentative short-term period.

Chasing Performance:

According to the Dalbar study, average mutual fund investors retain a fund for 3-4 years. When we read various investment articles, we are drawn to the hot performers. The problem is that just because an asset class or fund performed well last year, or the last few years, doesn’t mean it will continue to outperform. The Callan Periodic Table (shown below) provides a summary of performance of various asset classes, including US Large Cap, US Small Cap, International Developed, International Emerging, US Bonds, etc., for each year over the last 20 years. Last year’s best performing asset class is many times a laggard the following year. Rather than chasing performance, it is better to be invested in a portfolio that is allocated based on your risk tolerance and investing time horizon.

Selling Winners and Keeping Losers:

Investors hate taking losses. In a study by Kahneman and Tversky in 1979, they found that a loss has about 2.5x the emotional impact of a gain of the same magnitude. This helps explain why many investors will not sell investments at a loss. Instead they typically will sell securities in which they have a profit. This is just the opposite of the desired behavior: Let the winners ride and cut your losses. How often have you found yourself thinking that you would sell a losing investment once it “breaks-even”? “It has already gone down, so it can’t go down any more.” Then you finally end up selling it when it declines 25% or more, instead of having gotten out with a smaller loss.

An Investment Advisor Can Help:

One thing an investment advisor provides when managing your money is a level of detachment from the behavioral biases that we all have. It is much easier to be objective about someone else’s investment assets than your own. An investment advisor can help keep you invested when the market is experiencing difficult times, and help you sell your losers when the fundamentals of the investment no longer make sense. Just allowing your winners to ride and cutting your losses can make a huge difference in your retirement nest egg. That being said, no person or strategy can guarantee a gain or ensure against a loss. Investing has risks and there is always the possibility of losing money.

Feel free to contact us with any questions at info@L2Wealth.com.

Disclosures

All written content on this site is for information purposes only and should not be considered investment advice. Opinions expressed herein are solely those of L Squared Wealth Management LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another party’s informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

Advisory services are offered through L Squared Wealth Management LLC, an investment advisor firm domiciled in the State of California. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by our firm in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption. Advice may only be provided after entering into an advisory agreement with L Squared Wealth Management LLC.

Past performance is no guarantee of future results. Share prices and returns will vary so investors may lose money, especially when investing for short periods of time. No strategy can guarantee a gain or ensure against a loss.